- #1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET FULL#

- #1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET SOFTWARE#

When tracking expenses, it’s important to distinguish between personal and business expenditures.Contractors and other self-employed workers can deduct home office expenses, advertising expenses, accounting fees, phone bills, equipment depreciation, travel and car expenses, healthcare and retirement contributions, and more from their taxable income.Consult with your CPA to ensure you are reporting the deduction properly. You can deduct the health insurance cost event if you run into losses but it has to be reported differently.

#1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET FULL#

You can deduct the full cost of health insurance premiums on form 1040 but you must have an Income from your business. Health Insurance expenses: Premiums paid for your health insurance are tax-deductible. Other expenses – such as Dues & Subscriptions, Web development, and Business telephone expenses.Utilities –electricity, gas, telephone, internet.Meals and entertainment – You can include meals and entertainment expenses related to your business.Travel – the cost of traveling to a business-related event like convention, meeting, or business trip.Repairs and maintenance – Include all cost related to your business only.Rent or lease other business property – Cost of operating your business office.Office expense – Any supply or equipment you purchase for your business operation.You can include fees and other related cost. Interest Cost – Interest cost of your business loans.Insurance Cost – Business Insurance Expenses including life, property & casualty, or business insurance.Consultation Fees – Fee paid to professionals like attorney, CPA, or marketing professionals.Advertising – All expenses paid for online marketing or print marketing including business cards or flyers.What are some of the most popular business expense categories? We will assign each expense into appropriate categories based upon its tax implication. For example, you can simply send us your bank statement at the end of the month and we can do the complete bookkeeping. Most CPA firms also provide bookkeeping services.

#1099 EXPENSE INDEPENDENT CONTRACTOR EXPENSES SPREADSHEET SOFTWARE#

You can use a simple spreadsheet, financial software or you can use a shoe-box. Now, every time you pay a bill, you simply need to enter that transaction in the correct category.

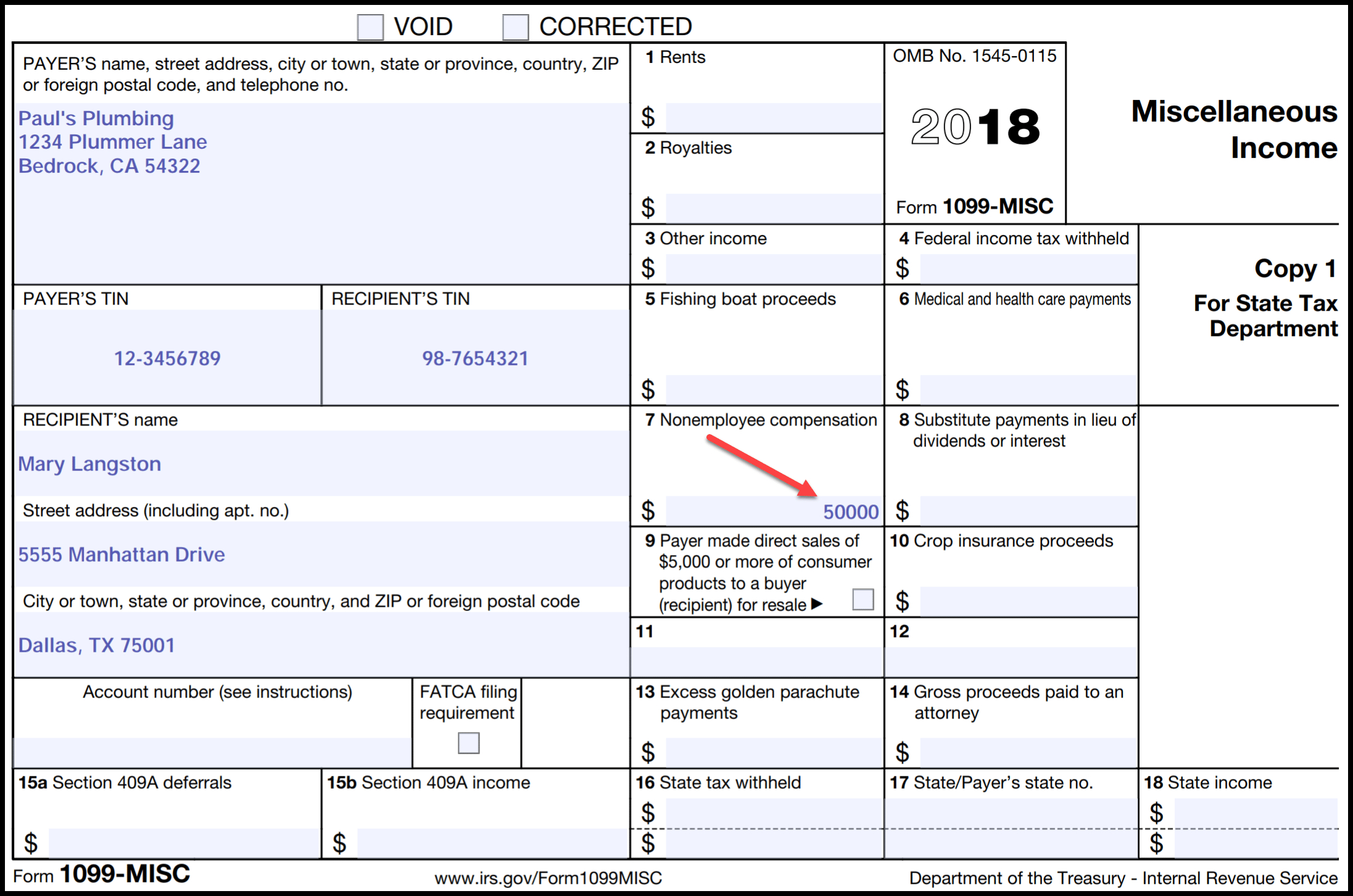

We recommend you use the same or similar categories listed on schedule C. The easiest way to do this is to categories your business expenses. Now you need to deal with your business expenses. Keeping a separate bank account will help in calculating total business income and you act as proof in case of an audit. You may get an automated customer-generated audit if you report a total income less than the amount listed on your 1099. That being said your total business income should be greater or equal to the amount listed in 1099. IRS will also reactive a copy of this 1099. Your client will send you to form 1099-misc at the end of the year. All business-related income should come to this account and all expenses should be paid from this account. Do not mix your business bank account with your personal bank account. You can start by opening a different bank account. So, how do you organize your income and expenses? However, it can also result in a heavy tax bill you do not organize your income and expense properly. Starting out a consulting business can be very lucrative.

0 kommentar(er)

0 kommentar(er)