- Bank of america dispute transaction phone number how to#

- Bank of america dispute transaction phone number upgrade#

- Bank of america dispute transaction phone number software#

Visit or call 877.322.8228 to obtain a credit report. Check your credit report to make sure there are no other accounts you're not aware of that have been opened in your name.Wherever the industry goes next, the best way to protect your business is to consider chargebacks at every stage of the customer journey - from preventing misconceptions when you make a sale, through to comprehensive record keeping and challenging the cases you think you can win.Act quickly and take the following actions: We’re seeing some interesting developments out there where rules engines do most of the heavy lifting, and operations efficiencies are found through a combination of artificial intelligence and robotics, which further reduces overall costs.” Ben Satterwhite comments, “Automation is key for any business in keeping their costs low when working their chargebacks. Many large corporations already use automated response tools matched with customer details, and this kind of automation based on intelligent actioning is where the industry is headed.

Bank of america dispute transaction phone number software#

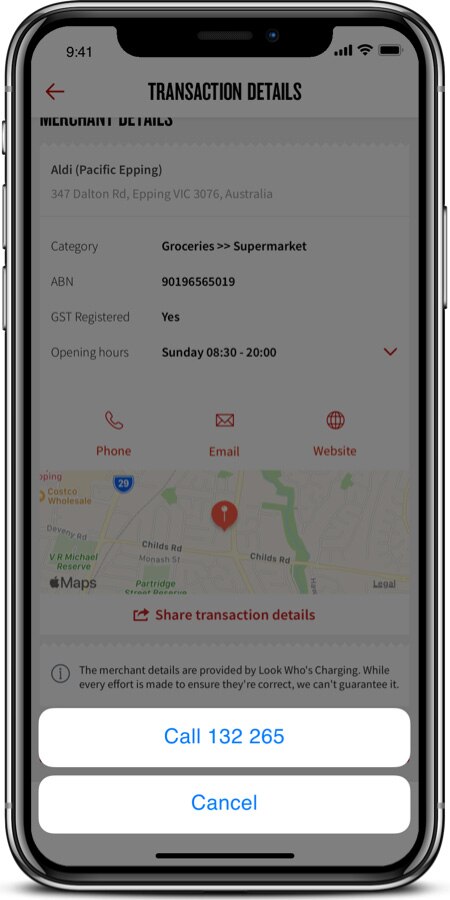

Bank of America offers software for managing chargebacks and has solution partnerships with outside providers, helping to automate processes and allowing merchants to take action and directly submit dispute documents. Only the largest companies tend to build their own software, but tools that automate and standardize the chargeback process are essential for businesses of any size. Build a documentation trail that proves you did what you said you would.” For example, keep billing information, shipping confirmation and signatures so you can demonstrate that goods were delivered or services carried out. Crucially, they respond within the time frames set by the card brands and use automated tools to collect and store information that can help them prove their case.Īs Ben Satterwhite, Senior Product Manager, Merchant Services at Bank of America, says, “The best thing to do is respond to chargebacks quickly with the appropriate documentation. Big retailers tend to take this approach, letting smaller amounts go as the cost of doing business but contesting larger sales. However, there is value in pursuing larger claims that you believe are errors or fraud. Because of low win rates and the fees involved, it can sometimes make more sense to pick your battles. One of the first things to consider is whether you’re going to fight every chargeback that comes through. He says, “If companies have a combination of incentives and clear guidance, their efforts on challenging chargebacks might be rewarded.” Patrick Neale, Senior Product Manager, Merchant Services at Bank of America, believes that making it easier to contest chargebacks and boosting internal awareness of them could increase win rates. And strengthening your customer service could pay off if it means customers will feel confident that you’ll listen if there’s a problem. For example, employees can be trained to follow through on voids and refunds. Even if you don’t have a large, dedicated team, you can still educate your workforce.

Bank of america dispute transaction phone number upgrade#

Upgrade to the latest payments technology.ĭespite your best efforts, chargebacks are going to slip through, but being prepared can help.Treat chargebacks like any other fraud, looking for patterns and staying vigilant.Verify any transaction that seems out of the ordinary or is over a preset amount.Use standard cardholder information, available to everyone, to verify transactions.Use all the payments tools at your disposal:.Comply with credit card brand rules and guidelines.

Put your customer service number, website and social media channels on receipts.

Bank of america dispute transaction phone number how to#

0 kommentar(er)

0 kommentar(er)